Brewing Trouble? New US Tariffs and the Coffee Capsule Market

The landscape of international trade has once again been significantly altered by the recent implementation of sweeping tariffs on imported goods by the United States, under the direction of President Trump.

These protectionist measures, enacted in April 2025, represent a notable escalation in global trade tensions and are poised to exert considerable influence across various sectors of the American economy. Among the industries facing potential upheaval is the coffee market, with a particular emphasis on the burgeoning sector of single-serve coffee capsules.

The newly imposed tariffs include a baseline levy of 10% on nearly all imported goods, with even higher “reciprocal” tariffs applied to specific countries based on trade deficits or perceived unfair trade practices. These measures follow earlier tariffs on steel and aluminum, which have now been expanded and raised to 25% on all imports, eliminating previous exemptions.

The implications of this revised tariff structure for the coffee industry, particularly the aluminum coffee capsule segment, are multifaceted and warrant careful examination.

The New US Tariffs Applying to the Coffee Industry

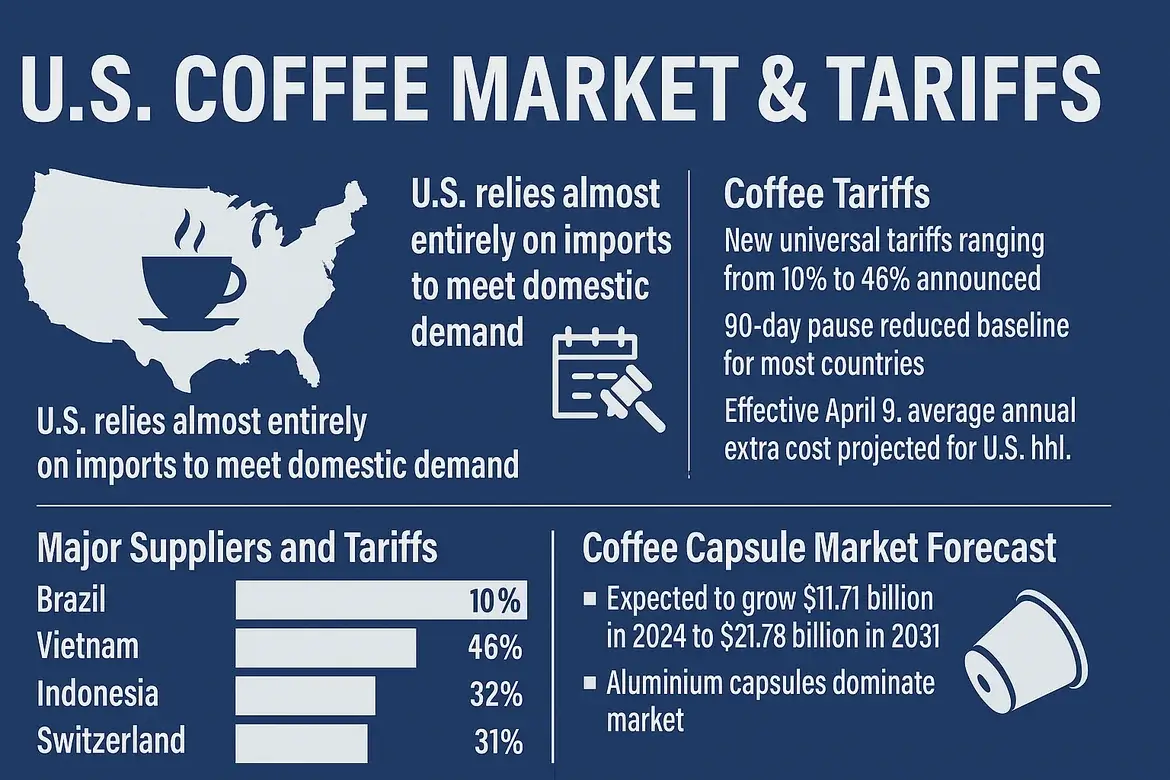

The United States, despite its significant coffee consumption, relies almost entirely on imports to meet domestic demand. In 2023, the US imported over $8.2 billion worth of coffee, making it a crucial component of the national economy and the daily lives of millions of Americans.

The imposition of tariffs on major coffee-producing nations, including Brazil, Colombia, Vietnam, and Indonesia, is predicted to trigger a rise in coffee prices for both consumers and businesses. Industry analysts anticipate that these tariffs, despite a temporary 90-day pause on the higher “reciprocal” rates for most countries, will ultimately be passed on to consumers, exacerbating existing inflationary pressures. The Yale Budget Lab estimates that the overall tariffs could result in an average extra cost of $3,800 per year for American households.

In fact, the coffee capsule market faces the prospect of increased costs for its primary filling material: coffee beans. On April 2, 2025, President Trump announced new universal tariffs on nearly all imported goods, including levies between 10% and 46% on imports from 15 of the world’s top 20 coffee-producing countries.

Although a 90-day pause brought the universal tariff down to a baseline of 10% for most countries (with China facing a significantly higher rate of 125%) effective April 9, the initial announcement caused considerable concern within the coffee industry.

Major coffee suppliers to the US, such as Brazil and Colombia, now face a 10% baseline tariff, while Vietnam, a key producer of robusta beans used in many capsule blends, initially faced a 46% tariff (later reduced to the 10% baseline during the pause). Indonesia, another significant coffee producer, faces a reciprocal trade levy of 32%. Even import from Switzerland, a major hub for the global coffee trade, now faces a 31% tariff.

Experts speculate that US importers could face tariffs ranging from 10% to 17% on coffee from countries like Colombia, Honduras, Guatemala, and Nicaragua, and potentially higher rates from Mexico. Given that the US imports over $8.2 billion worth of coffee annually and domestic production is negligible, these tariffs are expected to have a direct impact on the cost of green coffee for roasters and importers.

Experts predict that these increased costs will likely be passed on to consumers in the form of higher retail prices for coffee products, including capsules. The National Coffee Association has even formally requested an exemption for coffee from these tariffs, highlighting the lack of a domestic alternative. The combination of increased tariffs on both aluminum and coffee beans creates a significant upward pressure on the overall cost of producing and selling coffee capsules in the US market.

The coffee capsule market, a significant and growing segment within the broader coffee industry, is particularly susceptible to the impact of these tariffs. In 2022, the global coffee capsule market was valued at $5.9 billion and is projected to reach $11.9 billion by 2032, demonstrating a compound annual growth rate of 7.6%. Within this market, aluminum capsules held the dominant share in 2021, favored for their versatility, ease of use, and superior ability to preserve coffee freshness.

The North American aluminum coffee capsule market alone is projected to expand from $11.71 billion in 2024 to $21.78 billion by 2031, exhibiting a robust CAGR of 10.9%. Given the reliance on both imported coffee beans, and in many cases, imported aluminum capsules, the new tariff regime presents a complex set of challenges for private label coffee businesses operating in the US market.

Rising Costs of Raw Materials: The Foundation of the Issue

The implementation of new US tariffs is poised to significantly impact the cost structure for businesses involved in the coffee capsule market, primarily through increased expenses associated with the two fundamental raw materials: aluminum for the capsules themselves, and coffee beans for the filling.

The Trump administration’s recent trade policies include a substantial increase in tariffs on aluminum imports. Effective March 12, 2025, tariffs on all steel and aluminum imports were raised to 25%, eliminating previous exemptions for countries like Canada and Mexico. This action expands upon the initial Section 232 tariffs imposed in 2018, which set a 10% levy on aluminum.

The rationale behind this move, as stated by the administration, is to bolster domestic manufacturing and national security by countering what are perceived as unfair trade practices and global excess capacity. However, for the coffee capsule industry, which relies heavily on imported aluminum, particularly from key suppliers like Canada, this tariff hike translates directly into higher raw material costs.

While the US was once a leading producer of aluminum, its global share had fallen to less than 2% by 2021, making reliance on imports unavoidable. Metal packaging manufacturers have already voiced concerns that these tariffs will increase costs for both the industry and consumers. Even during the previous 10% tariff, price increases on raw aluminum were observed. The reinstated and amplified 25% tariff is therefore expected to further inflate the cost of aluminum for capsule production.

The Direct Impact on Private Label Coffee Businesses

The newly enacted tariffs pose a significant challenge to the profitability of private label coffee capsule businesses operating within the United States. These businesses, which often thrive on offering competitive pricing and specialized blends, face a dual threat from increased costs of both their primary input – coffee beans – and a key packaging component – aluminum.

As detailed in the previous sections, the tariffs on coffee imports from major producing regions are expected to drive up the cost of green coffee beans for US roasters and importers. For private label businesses, these increased costs directly impact their cost of goods sold. Given the relatively thin profit margins in the food and beverage industry, even a moderate increase in raw material expenses can significantly erode profitability.

The National Coffee Association has already warned that these tariffs could significantly increase consumer prices and disrupt established supply chains. For private label brands that compete on price, absorbing these costs may be unsustainable, while passing them on to consumers could risk losing market share in an increasingly value-focused environment.

Furthermore, the simultaneous increase in tariffs on aluminum imports to 25% directly affects private label businesses that utilize aluminum coffee capsules. Aluminum is favored for its recyclability and ability to preserve coffee freshness, and capsules made out of recycled aluminum, such as NovoCapsule’s, are especially beneficial for the environment. However, the additional 25% tariff on imported aluminum will likely exacerbate this cost differential, putting further strain on the profitability of private label brands that have chosen this premium packaging option. Metal packaging manufacturers have already expressed concerns about increased costs for both the industry and consumers due to these tariffs.

What to Do

Faced with these rising costs, private label coffee capsule businesses will need to explore various strategies to mitigate the impact on their profitability. One potential avenue is to carefully re-evaluate their strategies and optimize their product offerings, potentially adjusting blend compositions to utilize coffee bean varieties that are subject to lower tariff rates, without compromising the desired taste profile.

For businesses utilizing aluminum capsules, a critical decision will revolve around pricing. They may need to carefully consider a price increase for their products to offset the higher input costs. However, this must be balanced against the potential for reduced sales volume if consumers are unwilling to absorb the price hike. Alternatively, some businesses might explore absorbing a portion of the increased costs to remain competitive, albeit at the expense of their profit margins.

Ultimately, navigating the impact of these tariffs will require private label coffee capsule businesses to be agile and strategic in their decision-making, balancing cost considerations with the need to maintain product quality and consumer satisfaction in a potentially volatile market.

Will Consumers Feel the Pinch? Impact on Coffee Consumption

As the world’s largest coffee consumer, the US market’s response to price fluctuations could have significant ramifications for the entire coffee value chain, including the demand for single-serve capsules.

Given the anticipated price increases, a potential consequence is a decrease in overall coffee consumption in the US. While coffee enjoys a high level of demand and is considered a staple beverage for many, significant and sustained price hikes could lead some consumers to reduce their consumption frequency or volume. This would, in turn, impact the demand for coffee capsules, a segment that has thrived on convenience and a willingness among consumers to pay a premium for it.

Another potential shift in consumer behavior could be a move away from single-serve capsules towards more economical brewing methods. If the price of coffee capsules rises substantially due to the tariffs on both coffee and aluminum, consumers might opt for traditional drip coffee, French press, or other methods that offer a lower cost per cup. This would pose a direct challenge to the growth trajectory of the coffee capsule market, potentially leading to a contraction in demand.

The tariffs are also likely to impact the demand for premium and specialty coffee capsules. These segments often rely on high-quality arabica beans, which are primarily imported from countries now facing tariffs. The increased cost of these beans could make premium capsules significantly more expensive, potentially deterring price-sensitive consumers who might then switch to more affordable options or different brewing methods altogether. However, some loyal consumers who prioritize quality might be willing to absorb these increased costs, albeit potentially at a reduced consumption rate.

Considering the combined effect of tariffs on both aluminum and coffee, the final cost of a coffee capsule for the end consumer in the US is almost certain to increase. The extent of this price increase will depend on various factors, including the specific tariffs applied to the countries of origin for both aluminum capsules and coffee, as well as the pricing strategies adopted by private label businesses and retailers. Some businesses might attempt to absorb a portion of the cost increase to remain competitive, but widespread price hikes across the coffee capsule market are anticipated.

Operational Challenges and the Supply Chain

The imposition of tariffs by the US administration is not only expected to increase costs, but also to introduce significant operational challenges and potential disruptions to the established supply chains within the coffee capsule industry. These challenges will affect various stakeholders, from importers of green coffee and raw aluminum to the private label businesses involved in capsule filling and distribution.

One of the immediate impacts will be on the logistics of importing raw materials. Coffee importers are anticipating increased landed costs due to the tariffs, which will necessitate a re-evaluation of existing contracts and potentially the exploration of alternative sourcing countries. Florian Schaffner, CFO of Algrano, notes that roasters and importers will see their landed costs increase overnight, affecting not only new contracts but potentially also coffee already in transit. This could lead to delays in decision-making on new purchases, especially for forward-looking volumes, adding another layer of uncertainty to an already complex situation marked by sustained high green coffee prices.

For private label coffee capsule businesses, ensuring the compatibility of empty aluminum capsules with their existing filling equipment will be a critical operational concern. Furthermore, the tariffs may influence investment decisions regarding operational upgrades. They may give rise to a dilemma in deciding where long-term cost-saving measures might be deferred due to immediate concerns about capital expenditure in a tariff-burdened environment.

The complexity of the new tariff regime, with its baseline tariffs and country-specific reciprocal tariffs, also adds a layer of bureaucratic burden for importers and private label businesses. Peter Bay Kirkegaard from the Confederation of Danish Industry speculates that importers might need to manage over two million potential tariff lines under a reciprocal model, significantly increasing administrative complexity. This necessitates a thorough understanding of the specific tariff codes and regulations applicable to both coffee and aluminum imports from various countries to ensure compliance and avoid potential penalties or delays in customs clearance.

Finally, the potential for retaliatory tariffs from other countries in response to the US measures could further complicate supply chains. This could lead to further disruptions and increased costs across the global coffee trade, affecting the availability and pricing of both coffee beans and aluminum coffee capsules.

Shifting Market Dynamics and Competition

The imposition of US tariffs will most likely also instigate significant shifts in the market dynamics and competitive landscape of the coffee capsule industry. These changes may manifest in altered consumer preferences regarding packaging materials, the emergence of new opportunities for domestic manufacturers and a re-evaluation of the price competitiveness between imported and domestically produced capsules.

Lowering costs for aluminum coffee capsules may not be possible, though, with the increasing consumer awareness of environmental issues which may further propels the demand for recycled aluminum coffee capsules, even if the price goes up due to tariffs. This could see the rise of local players in the aluminum coffee capsule market.

Broader Economic and International Implications

The imposition of tariffs by the United States on key commodities such as coffee and aluminum carries significant potential for broader economic and international repercussions, particularly as they relate to the nuanced dynamics of the coffee capsule industry. Understanding these implications necessitates an examination of potential retaliatory measures and the cascading effects on pricing and consumer behavior.

For example, the imposition of tariffs on coffee and aluminum can exert upward pressure on the prices of Nespresso machines and other single-serve coffee brewers in the US market, consequently influencing the consumption patterns of coffee capsules.

Increased prices for Nespresso machines and other single-serve brewers can have a dampening effect on the demand for these appliances. As the adoption rate of these systems slows due to higher upfront costs, the corresponding consumption of coffee capsules associated with them may also experience a deceleration in growth.

This is particularly relevant in a market where price sensitivity among consumers exists. Economic studies on the adoption of durable goods often highlight the inverse relationship between price and demand (e.g., Mankiw, 2021). If the cost of entry into the single-serve coffee ecosystem (i.e., purchasing a brewer) becomes prohibitively expensive for some consumers, the long-term growth trajectory of capsule consumption could be negatively impacted.

Higher prices for brewing machines might also lead to a shift in consumer behavior. Some consumers might delay purchasing a new machine, opt for less expensive brewing methods, or explore alternative single-serve systems that are less reliant on tariffed materials or originate from countries not subject to the tariffs. This could lead to market share shifts within the coffee industry, with potential implications for the dominant players in the capsule segment.

A comprehensive understanding of these interconnected dynamics is crucial for stakeholders in the coffee capsule industry to navigate the evolving global trade landscape and mitigate potential negative impacts. Continuous monitoring of international trade relations and consumer price elasticity will be essential for strategic decision-making in this context.

The Future Outlook for the Impact of Tariffs on the U.S. Coffee Capsule Market

The imposition of new U.S. tariffs on imported coffee products in 2025 has galvanized significant advocacy and lobbying efforts within the coffee industry, aiming to mitigate the adverse effects on businesses and consumers.

In response to the tariffs, several industry-led initiatives have emerged. The National Coffee Association (NCA), representing over 200 stakeholders across the coffee supply chain, has been at the forefront of these efforts. In March 2025, NCA President and CEO Bill Murray addressed a letter to U.S. Trade Representative Jamieson Greer, emphasizing the unique position of coffee as a non-substitutable import.

Murray highlighted that coffee supports over 2.2 million U.S. jobs and contributes approximately $343 billion annually to the economy. He warned that tariffs could raise retail coffee prices by up to 50%, disproportionately affecting consumers and small businesses.

In addition to formal lobbying, the NCA has engaged in educational initiatives to inform its members about the implications of the tariffs. For instance, the association hosted a webinar featuring trade attorneys Rachael Spiegel and Mollie Sitkowski, discussing the latest updates on U.S. trade policy, tariffs, and their impact on coffee imports.

Complementing the NCA’s institutional advocacy, grassroots movements have emerged to amplify the industry’s concerns. Notably, Coffee Bros., a New York-based specialty coffee roaster, launched a petition titled “Exempt Coffee from Tariffs: Protect American Small Businesses and Preserve Coffee Quality.” The petition argues that the tariffs threaten thousands of small businesses and millions of jobs, given that coffee cannot be produced at scale in the United States. It calls for immediate exemption of coffee from the tariffs and recognition of coffee as an essential, non-manufacturable good.

These advocacy efforts underscore the industry’s unified stance against the tariffs and its commitment to preserving the vitality of the U.S. coffee market. While the government has acknowledged these concerns, no definitive policy changes have been announced. The situation remains fluid, with potential adjustments depending on economic indicators and political considerations.

Navigating the Tariff Terrain in the Coffee Capsule Industry

The introduction of sweeping U.S. tariffs on imported coffee has ushered in a challenging new era for the coffee capsule industry. The immediate repercussions of these tariffs have included sharp increases in import costs, disruptions to established supply chains, and elevated retail prices, all of which threaten to reshape consumer behaviors and potentially slow the previously robust growth trajectory of the capsule market in the United States.

The tariffs are likely to influence long-term industry dynamics profoundly, prompting manufacturers and private-label companies to reassess sourcing strategies, consider alternative production locations, and possibly invest in domestic manufacturing capabilities. Businesses may benefit from actively participating in industry advocacy efforts, supporting lobbying initiatives led by organizations like the National Coffee Association. Enhancing transparency about sourcing, emphasizing sustainability credentials, and demonstrating clear value propositions to consumers could help mitigate the impact of increased prices.

For companies such as NovoCapsule and their clientele, navigating this altered landscape will require proactive, strategic responses. Strategically, companies should explore diversifying supply chains or entering into partnerships that may help adjust to this new terrain. Investing in innovation around packaging materials and sustainable solutions could further distinguish companies, creating value beyond price competition alone.

Ultimately, successful navigation of this complex economic environment will hinge on agility, clear communication with stakeholders, and the willingness to adapt swiftly to market conditions. The industry’s collective efforts to engage policymakers and advocate for tariff reconsiderations will also play a crucial role. In the face of ongoing uncertainty, proactive, flexible strategies remain the best approach to maintaining resilience and ensuring sustained growth in the evolving coffee capsule market.

NovoCapsule is particularly well-positioned to support coffee businesses in this complex environment through its commitment to cost-effective solutions, innovative capsule designs, and a robust, adaptable supply chain.

Leveraging NovoCapsule’s capabilities can offer distinct advantages in mitigating tariff-related disruptions, as its streamlined production processes, strategic sourcing, and efficient logistics are specifically designed to optimize operations and maintain profitability, even under challenging trade conditions.

Partnering with NovoCapsule provides coffee brands access to high-quality aluminum capsules that are fully compatible with popular coffee machines, thereby allowing businesses to uphold premium standards without passing prohibitive costs onto consumers.

NovoCapsule’s extensive experience and deep industry insights enable clients to remain resilient and competitive, positioning them for growth despite market volatility.

To explore how NovoCapsule’s expertise can support your brand through these tariff challenges, reach out to us today and help your business thrive even amidst uncertainty.