Minimum Order Quantity Aluminum Coffee Capsules vs. Plastic Pods:

A Straight-Up Cost and Quality Showdown

Key Takeaways

Aluminum’s higher MOQ is a strategic asset. Tooling amortizes quickly and per-unit costs converge with plastic once volumes climb past the 150 K mark, while flavor protection and recyclability start paying dividends from day one.

Cost transparency beats sticker shock. Break quotes into tooling, unit price, QC, and logistics. Negotiate community runs or phased dies to keep early cash exposure manageable.

Sustainability drives shelf space and fees. Aluminum’s closed-loop value lowers EPR charges, meets retailer scorecards, and reinforces your premium positioning far beyond the procurement desk.

Smart planning de-risks capital. Align marketing launches, distributor POs, and recycling programs with production windows so inventory moves quickly and cash recycles just as fast.

When you sign off on a minimum order quantity (MOQ) for single-serve capsules, you’re betting real cash on how quickly your coffee will move, and on how your brand will be perceived from day one. Order too few, and every capsule inherits a hefty share of setup costs. Order too many, and valuable inventory may age in a warehouse while you scramble to sell it.

Striking the right MOQ, and choosing between aluminum and plastic formats, is therefore a strategic decision that touches working capital, shelf life, and brand story in equal measure.

***

Why Does Minimum Order Quantity Matter When You’re Scaling a Private-Label Capsule Line?

MOQ shapes three critical dimensions of a young coffee brand’s trajectory:

- Cash-Flow Discipline

The MOQ you accept sets the bar for your initial cash outlay. Aluminum suppliers typically ask for larger runs because high-precision tooling and faster production speeds only make sense when the machines run continuously. That bigger commitment ties up capital in inventory, money that could otherwise fuel marketing or product development, so you must be confident about demand forecasts. - Speed-to-Shelf and Product Freshness

Larger MOQs lengthen the time between ordering and sell-through. Coffee’s flavor clock keeps ticking, yet aluminum’s airtight barrier buys you extra weeks of peak aroma compared with plastic pods. That buffer lets you ship farther afield or hold stock for seasonal promotions without compromising cup quality. But only if your sell-through projections are realistic. - Brand Positioning and Perception

A sizeable aluminum order signals that you’re playing in the premium, sustainability-minded tier. Retail buyers and corporate clients notice the weight, the precise fit in Nespresso® machines, and the recyclability badge on the sleeve. Plastic’s lower MOQ may conserve cash, yet it risks labeling the brand as cost-driven just as consumers are trading up for flavor integrity and eco-credibility.

Get MOQ wrong, and you either bleed margin on every cup or hoard pallets of stale product. Get it right, and you unlock a virtuous cycle – steady cashflow, reliable quality, and a brand story that sells itself.

What Drives MOQ Differences Between Aluminum Capsules and Plastic Pods?

Minimums aren’t arbitrary. They reflect the economics behind each material’s manufacturing line.

Precision tooling and change-over costs

Aluminum capsules are stamped and formed on high-speed rotary presses fitted with multi-cavity steel dies. Bringing those dies up to temperature, aligning them to micron tolerances, and running quality checks takes hours, and the only way a supplier recovers that setup time is by keeping the press rolling for a full shift.

That’s why private-label aluminum runs routinely start at 30,000–50,000 units per SKU. Plastic pods, by contrast, rely on simpler injection molds that tolerate quick swaps, allowing factories to profit on batches as small as 1,000 pieces.

Throughput versus flexibility

Once aluminum tooling is dialed in, output skyrockets, with eight-lane presses that can mint hundreds of capsules per minute. The catch is that every interruption (new blend, color, or emboss) forces a complete reset. Plastic lines run more slowly, but their stop-and-start agility lets suppliers aggregate many micro-orders in a single day. The result: aluminum favors long, uninterrupted runs, while plastic rewards variety and just-in-time production.

Material value and scrap recovery

Aluminum has an intrinsic resale value, so suppliers collect every shaving and rejected shell for remelt. That salvage stream subsidizes longer runs but only at scale. Scrap from a tiny batch wouldn’t cover the energy bill. Plastic offcuts, worth pennies, impose little financial penalty for short runs, another reason pod makers accept lower MOQs.

Customization premiums

Add a custom color anisotropic anodizing, laser embossing, or bespoke lidding film and the MOQ climbs further. Each variant demands its own setup, so suppliers bundle those costs into a higher starting volume for aluminum, sometimes pushing the threshold past 50,000 units. Plastic pods use off-the-shelf pigments and printable lids, keeping custom MOQs comparatively flat.

Capacity scheduling

Large roasters book aluminum lines months ahead to secure uninterrupted shifts. To avoid idle presses, manufacturers lock smaller brands into a “community run” on set dates. Miss the slot and your launch slips. Plastic suppliers, juggling dozens of molds, can slot in ad-hoc orders with minimal disruption.

In short, higher aluminum MOQs aren’t a pricing tactic. They’re the by-product of capital-intensive presses, salvage economics, and the premium cues that make metal capsules worth stocking. Understanding those levers puts you in a stronger position to time your order, negotiate shared tooling, or join a consolidated production window so you capture aluminum’s quality halo without tying up more cash than your growth plans justify.

How Much Does Tooling Really Cost, and Can It Be Amortized at Lower Aluminum MOQs?

The sticker shock on aluminum tooling is real. A precision deep-draw die built from hardened steel can run from “a few thousand” for a simple cavity to “tens of thousands” once you add multi-cavity plates, cooling channels, and embossing inserts. By contrast, a single-cavity plastic-pod mold often costs no more than US $2,000–5,000, even less when suppliers repurpose an existing mold and merely swap a core pin for your logo.

Viewed in isolation, that delta looks brutal. Viewed over the life of a product, it narrows fast: amortize a US $25,000 aluminum die across a first run of 100,000 capsules and you add roughly US $0.25 to each unit, higher than plastic, but only until volume climbs. Double the output to 200,000, and the tooling burden falls to US $0.13. At half-million scale it’s down to nickel territory. Because aluminum presses run faster and scrap is recycled back into the melt, the sheer throughput eventually overtakes the cheaper mold on total cost of ownership.

Suppliers also offer creative ways to soften the upfront hit:

Shared or “community” tooling. Multiple brands agree on a common body shape. Each pays only for unique lid artwork and color anodizing.

Tool-in deposit with buy-back. You pay the full die cost, but after a set volume, say 1 million units, the supplier rebates a percentage or credits future orders.

Phased cavities. Start with a two-cavity die to keep initial MOQ at 40,000. Add inserts later to expand to eight cavities without redesigning the block.

Strategic co-branding. Align with a roaster or corporate customer so their first purchase order immediately spreads the tooling across two SKUs.

The takeaway: tooling is a front-loaded investment, not a sunk cost. If your growth plan envisions even a mid-six-figure run over 12-18 months, aluminum’s upfront premium becomes marginal, and the gains in flavor stability, brand perception, and recyclability often repay the difference long before the die reaches end-of-life.

Where Does Flavor Protection Tip the Scales in Favor of Aluminum, Even at Higher MOQs?

The moment roasted beans cool, three quiet saboteurs – oxygen, light, and humidity – start stripping away the volatile oils that give a capsule its signature aroma. Plastic pods slow the loss, but they never fully seal it out. Trace oxygen continues to seep through thin sidewalls for months. Aluminum, by contrast, behaves like a micro-vault: once the capsule is flushed with inert gas and crimp-sealed, the oxygen transfer rate drops to “effectively zero,” keeping moisture and UV light out as well.

Shelf-life becomes a strategic asset. Independent lab tests commissioned by specialty roasters routinely show that espresso packed in aluminum is still “on-spec” after 12-15 months, whereas the same coffee in polypropylene pods can taste flat in half that time.

Brands that sell through global distributors or need to ride out seasonal demand spikes gain room to breathe, and room to negotiate retailer performance fees tied to freshness. Even if you commit to a larger first run, less product ages out or needs discounting, softening the cash-flow hit of a higher MOQ.

Sensory consistency fuels repeat purchase. Single-origin or micro-lot SKUs live or die on razor-edge flavor notes: a hint of bergamot in a natural-process Ethiopian, the caramel snap in a Colombian honey. Aluminum’s airtight barrier keeps those delicate compounds intact all the way from filling line to final sip.

In contrast, plastic’s slow leak can blur those notes into generic roastiness, eroding the very differentiation that lets you command premium pricing. For private-label owners courting discerning café chains, hotel groups, or corporate offices, that consistency is the difference between a one-off listing and a multi-year supply contract.

Less wastage, quieter returns. Retail partners judge suppliers on shrink and customer complaints. When oxygen-bled capsules hit store shelves, they trigger returns, markdowns, and branded “not as fresh as advertised” chatter online. Aluminum’s longer sensory life reduces that drag on margin and reputation, turning what looked like a steeper upfront MOQ into an insurance policy against stale inventory and negative reviews.

The bottom line is that flavor integrity isn’t a soft benefit. It’s a revenue safeguard. If your brand promise leans on specialty-grade beans or sustainability credentials, aluminum’s barrier performance lets you keep that promise at scale, making the higher MOQ a cost you recoup in preserved quality, stronger re-orders, and fewer write-offs.

Can Recycling Economics Offset the Up-Front Commitment to Aluminum MOQs?

Aluminum is one of the few packaging metals that keeps its value after a single use. Scrap buyers routinely pay ≈ US $1,250 per ton for used-beverage-can (UBC) material, the same alloy family used in most premium capsules, so every rejected shell and post-consumer pod represents cash, not waste.

When suppliers melt that scrap back into feedstock, they recoup part of each production run’s cost and can share the savings with brand partners through line-item “scrap credits” or discounted future orders.

Plastic pods offer no comparable dividend. Mixed polymers fetch pennies on the dollar, and soft-plastics recycling rates hover in the single digits. Australia’s national program, for example, still landfills 94% of collected material because markets for the output don’t exist.

That zero-value end-of-life profile forces producers to absorb higher extended-producer-responsibility (EPR) fees in Europe and looming U.S. state levies, costs that aluminum often sidesteps thanks to its closed-loop potential.

Brand-run take-back schemes amplify the advantage. Nespresso’s global system now captures roughly 35% of the capsules it sells, funneling them into dedicated smelters and reinjecting the metal, up to 80% recycled content in some lines, back into new pods. Private-label owners can hitch a ride on similar infrastructure or negotiate joint programs with their filler, turning spent capsules into a marketing story and a modest revenue stream that chips away at the higher MOQ’s carrying cost.

Viewed over a two- or three-year horizon, those recycling rebates plus lower EPR penalties can erase a meaningful slice of the initial aluminum tooling and inventory investment, effectively turning the metal’s end-of-life premium into an ongoing price hedge rather than a sunk cost.

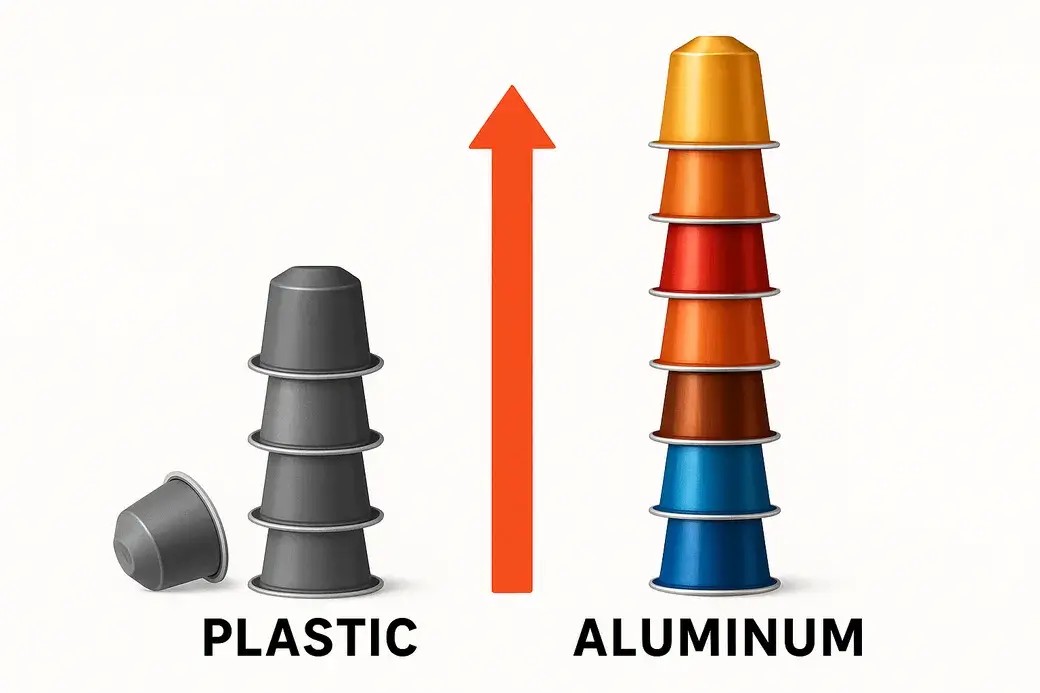

How Do Per-Unit Costs Evolve Across 50 K, 150 K, and 500 K Capsule Tiers?

The 50 K launch-run:

At this entry tier, each capsule still wears most of the line-setup cost. Listings for finished, filled aluminum pods aimed at private-label buyers run close to US $0.20 apiece at ~33 K-50 K units, more than double a comparable plastic pod, which sits around US $0.09 at the same volume. For brands testing a single SKU, that delta feels steep, but remember it already includes the die amortization and the first quality checks that make aluminum “retail-ready.”

The 150 K growth step:

Scale starts to bite here. Once the press stays hot for multiple shifts, fixed costs spread out and scrap metal begins to flow back into the smelter as a credit. Suppliers routinely quote aluminum shell-and-lid packages in the low-to-mid-teens per unit at this volume, roughly a 30% haircut versus the launch run, while plastic slips only a few cents because it was cheap to begin with. Net result: the gap narrows from more than 2:1 to roughly 1.4:1. The brand now decides whether flavor integrity and sustainability upside justify the extra four or five cents per cup.

The 500 K efficiency lane:

By the half-million mark, aluminum tooling is fully paid down and the line is running at its designed throughput. Raw capsule cost can land as low as five or six cents, practically shoulder-to-shoulder with high-volume plastic. On the all-in cost stack, the difference that once looked like a premium has largely evaporated, especially when you credit back the recycling revenue and factor in fewer write-offs from oxygen fade. At this scale, aluminum’s superior barrier and circular-economy story come almost “for free,” tipping total cost of ownership decisively in its favor.

What Hidden Fees Lurk Below the Stated MOQ, and How Can You Dodge Them?

Suppliers rarely bury costs on purpose, yet a modern capsule line has so many moving parts that invoices can swell well beyond the headline price per unit. The four most common culprits are change-over surcharges, custom-component premiums, time-based penalties, and post-production carrying costs.

Change-over surcharges.

Each time a press switches body color, lid graphic, or emboss pattern, technicians must drain hoppers, recalibrate sensors, and run fresh QC samples. Even “minor” swaps can add several hours of downtime, and that bill, often expressed as a flat fee of a few hundred dollars per reset, gets folded into the first pallet you buy. The smaller your order, the bigger the impact on unit economics.

Custom-component premiums.

Unique anodized hues, laser engraving, or specialty lidding films require batch-size minimums of their own. A metallic-teal finish might mean purchasing an entire drum of pigment or foil, regardless of whether you need the full drum. Unless you have multiple SKUs sharing that component, the leftovers are effectively a sunk cost.

Time-based penalties.

Rush orders leapfrog the queue but attract overtime rates for both labor and utility usage. Conversely, delayed artwork approval or late payment can trigger “standby” fees if the line is idled while waiting on your green light. Both scenarios erase any price advantage you negotiated up front.

Carrying and compliance costs.

Finished capsules that linger in the factory past an agreed pick-up window accrue warehousing charges. If you’re shipping into regions with strict food-contact rules, mandatory migration tests or extra certificates can add hundreds to the QA budget, expenses sometimes invoiced after the fact.

Dodging the pitfalls:

- Lock specs early. Freeze colors, lid designs, and blend recipes before the purchase order hits the supplier’s ERP. Every late tweak risks a reset fee.

- Bundle variants. Where practical, group multiple SKUs into a single run so change-overs happen once, not three times.

- Negotiate “all-in” pricing. Ask the supplier to roll setup, QC sampling, and basic certificates into one consolidated rate; transparency removes surprises.

- Agree on a pick-up calendar. Split the order into timed call-offs that fit your warehouse capacity, and confirm exactly when storage fees kick in.

- Audit the test matrix. Verify which food-safety or migration reports are legally required for your destination market. Skip optional add-ons unless a retailer demands them.

Identify and defuse these extras early, and the MOQ you commit to is the real figure that shows up on the invoice, keeping your launch budget intact while still reaping aluminum’s quality and sustainability dividends.

How Does MOQ Influence Lead Time, Inventory Footprint, and Cash-Flow Planning?

Lead time: why bigger orders arrive slower, and faster.

On paper, aluminum lines run faster than plastic, but they also lock into longer production windows. One plate of NovoCapsule’s contains around 280,000 empty capsules, and a container – around 3 million. Plastic’s shorter runs squeeze onto the schedule sooner, yet each unit spends more minutes on the mold, so total door-to-door timing often evens out. The net effect: as MOQ rises, calendar lead time flattens.

Inventory footprint: pallets versus payables.

Storing millions of empty aluminum capsules isn’t just about square meters. It’s about stacking height, humidity control, and rotation discipline. Capsules are light, so the true cost is the “air” you warehouse and the insurance on that idle working capital.

Brands that can’t accommodate the full load often negotiate staggered call-offs: the factory produces the lot in one run, then drip-feeds pallets on an agreed calendar, smoothing cash outlay and freeing floor space.

Cash-flow modelling: matching burn rate to sell-through.

Aluminum’s higher MOQ may cause a somewhat higher pricing. Offset that by projecting a conservative sell-through curve:

Many private-label roasters aim to recoup the first tranche within 90 days of landing stock. Aluminum’s longer shelf life helps. Product stays retail-fresh through two full quarterly cycles, while plastic demands a faster churn. A simple rule of thumb: if your monthly capsule velocity (units sold ÷ months) is at least one-eighth of your MOQ, you can cycle cash fast enough to keep marketing and operating budgets healthy.

Mitigation levers.

Negotiate milestone payments tied to production phases (tooling, filling, dispatch) rather than one lump sum.

Secure distributor pre-orders or retail commitments before triggering the press; the PO acts as collateral with finance partners.

Align launch campaigns with the capsule delivery window – social teasers, subscriber boxes, retailer shelf resets – so sell-through starts within days of stock arrival.

To sum up, MOQ is not merely a procurement hurdle. It dictates how early you lay out cash, how long capital sits in corrugated sleeves, and how quickly revenue fires back into the account. Treat lead time, storage capacity, and marketing cadence as a single equation, and the “big-order” anxiety surrounding aluminum melts into a manageable, forecast-driven plan.

Which Sustainability Metrics Strengthen the Case for Aluminum at Scale?

Carbon intensity per serving

Life-cycle studies show that the bulk of a cup’s footprint comes from growing and roasting the coffee itself; packaging makes up only a sliver. When that packaging is aluminum, it adds about 11 g CO₂-eq per lungo cup, roughly on par with compostable “coffee-ball” formats and well below the emissions created when a plastic pod lets coffee go stale and forces a second brew.

Because aluminum’s barrier keeps aromas intact for up to 15 months, fewer stale capsules are discarded, cutting the “hidden” carbon of wasted coffee that dominates every LCA. Research summarized in Wired underscores the point: recyclable aluminum pods rank as the most climate-efficient single-serve option once brewing energy and food waste are factored in.

Real-world recycling rates

Globally, around 69% of all aluminum ever produced is still in circulation, a closed-loop performance no plastic can match. Even within the capsule niche, Nespresso’s take-back system already captures 35% of spent pods, a figure that rises every time a roaster co-brands its program with local municipalities.

Plastic pods, by contrast, hover in the single digits because mixed polymers and residual coffee grounds make mechanical sorting uneconomic. High MOQs let brands piggy-back on established aluminum recovery networks at scale instead of trying to build parallel systems for plastics.

Extended-producer-responsibility (EPR) fees

Under the EU’s Packaging and Packaging Waste Regulation, producers must finance the entire life-cycle of their capsules. The more recyclable and valuable the material, the lower the fee. Aluminum’s resale value offsets collection costs, trimming the EPR bill that plastic-pod importers now face. Commit to a production run large enough to label every sleeve with clear “metal recycling” instructions, and you unlock reduced fee tiers that don’t apply to mixed plastics.

Retailer scorecards and mono-material targets

Major grocery chains already give preferential shelf space, or lower listing fees, to mono-material packs that hit recyclability thresholds. The surge in mono-material packaging (up 6.4% CAGR through 2034) is being driven by exactly those scorecards.

Aluminum capsules sail through because the body and lid share the same alloy family. Plastic pods often fail or require complex “peel-off” instructions consumers ignore. High MOQs ensure you can certify alloy purity and recycled-content percentages for every batch, paperwork buyers increasingly demand.

Recycled-content commitments

Nespresso already produces caps with 80% recycled aluminum and is targeting higher ratios as scrap supply grows. Suppliers reserve that premium alloy for customers who order in full-shift lots. A 30 K stop-and-start run rarely justifies draining a dedicated recycled-metal furnace. By stepping up to a larger MOQ, you qualify for higher recycled content and can print the claim on pack, turning sustainability into a front-of-shelf selling point.

In brief, when you look past the unit price and focus on hard metrics, carbon intensity, collection rates, EPR discounts, retailer scorecards, and recycled-content thresholds, aluminum’s sustainability story gets stronger as volume rises. Meeting a higher MOQ isn’t a cost you swallow, it’s the ticket to carbon-smart packaging, lower compliance fees, and a credibility halo that plastic pods simply can’t match.

How Can Emerging Brands Secure Lower Aluminum MOQs Without Compromising Quality?

Leverage “community runs.”

Most capsule fillers allocate dedicated blocks on their high-speed presses for smaller, like-spec customers. By aligning artwork approvals and flavor calendars with a community slot, you ride the same tooling and QC regime as larger brands while only committing to a fraction of the shift output, often as low as 20,000–25,000 units. You pay a modest scheduling premium, but you avoid the full burden of a solo run.

Negotiate phased tooling upgrades.

Ask suppliers to start with a two-cavity die and pre-machine the steel block for future expansion. You launch at a lower MOQ while locking in a fixed price for the additional cavities later. Because the machining paths are planned up-front, the supplier saves re-engineering time and passes on those savings when you scale.

Tap into vendor-backed financing.

Reputable aluminum suppliers frequently partner with trade-finance houses that underwrite tooling or first-run inventory against confirmed purchase orders from distributors or cafés. Spreading the cost across six- or nine-month terms lets you meet a slightly higher MOQ today without draining working capital that fuels marketing tomorrow.

Bundle SKUs under one “umbrella MOQ.”

If you’re launching multiple blends, combine them into a single production slot: 10,000 Ethiopia, 10,000 Colombia, and 10,000 Decaf still add up to the 30,000-unit threshold most fillers require. You share body tooling across blends and vary only the lid artwork or sleeve, keeping per-variant volume manageable.

Use pre-qualified material specs.

Suppliers often hold stock of standard alloy and lid films that already meet food-contact and migration tests. By opting into those pre-qualified specs, rather than specifying exotic anodizing or embossed artwork, you bypass extra QA cycles and keep minimums lower.

Offer a volume-acceleration clause.

Agree to place a follow-up order within a set timeframe (e.g., three months) if velocity targets are met. The supplier hedges line uptime, so they’re willing to shave the initial MOQ in exchange for contractual visibility on the ramp-up.

Secure co-marketing partnerships.

Align with a complementary brand (plant-based creamer, café chain, office-coffee distributor) to co-brand the capsule sleeve. Shared branding often qualifies you for the larger partner’s preferred-customer status, unlocking their lower MOQ tier and higher priority on the production calendar.

The result of combining smart scheduling, phased tooling, creative financing, and strategic partnerships, emerging brands can access aluminum’s flavor and sustainability advantages at volumes that align with realistic sell-through projections – never sacrificing the rigorous QC or precise tolerances that give metal capsules their premium edge.

When Does It Make Sense to Blend Aluminum and Plastic Capsule Offerings?

For some private-label roasters, a single-material strategy is cleanest, yet market realities can justify a two-tier portfolio. Before you jump, weigh the following triggers:

Price-tier segmentation

If your buyer universe spans budget grocery lines and upscale hospitality accounts, dual formats let you match cost expectations without diluting either brand message. Aluminum becomes the flagship, marketed for flavor integrity and recyclability, while plastic carries value-driven SKUs aimed at price-sensitive channels. The trade-off is complexity: separate BOMs, QA plans, and marketing narratives must stay perfectly partitioned to avoid cannibalization.

Regional infrastructure gaps

Certain markets, parts of Southeast Asia or Latin America, lack curbside metal recycling but accept polypropylene in existing streams. A supplemental plastic range can unlock those geographies while you lobby for aluminum take-back partnerships. Just be transparent: call out the roadmap toward full aluminum adoption so sustainability-minded customers see progress, not mixed messaging.

Promotional or seasonal SKUs

Limited-run flavors (pumpkin-spice, holiday blends) often sell in short bursts. If demand peaks at 15,000 units, a plastic capsule’s lower MOQ keeps cash tied up for only a few weeks. Use them as “trial balloons”: if a seasonal SKU over-performs, migrate it to aluminum for the permanent range next year.

Production-capacity constraints

High-speed aluminum lines book out months ahead. If an unexpected retailer listing lands and you need product in six weeks, plastic’s flexible scheduling can bridge the gap. Protect your premium brand equity by positioning the stop-gap SKU as an “introductory edition” while flagging the aluminum upgrade already in the pipeline.

Risk diversification

Raw-material shocks, think aluminum surcharges or polymer shortages, can squeeze margins overnight. Running parallel supply chains hedges against volatility, provided your SOPs keep quality and sensory profiles consistent across materials. NovoCapsule uses aluminum that is 90% recycled, which allows it to provide smooth and constant supply even in times of shortage.

Operational caution

Dual materials double your SKU count and safety-stock calculations.

Food-contact and recycling claims differ. Mis-label one sleeve and corrective actions get expensive fast.

Mixed portfolios can confuse eco-conscious buyers if messaging isn’t razor-specific about why each material exists.

The verdict is to blend only when the upside – market reach, speed, or risk mitigation – clearly beats the added complexity. And treat plastic as a stepping stone for specific and temporary use only, not a parallel flagship: every communication touchpoint should reaffirm aluminum as the long-term destination for flavor, brand prestige, and circular-economy credibility.

What Are the Action Steps to Lock In Your First Aluminum Capsule Order?

- Define your spec before talking price.

Nail down the essentials: capsule body size (Nespresso® Original or Vertuo-compatible), intended fill weight, roast curve, and any branding elements like embossing or anodized color. When a supplier sees a precise brief, not vague “premium capsule” language, they fast-track quoting and slot you ahead of less organized prospects. - Build a three-quote baseline.

Request itemized proposals from at least three fillers. Ask each to separate tooling, per-unit cost at your target volume, QC charges, and freight. A clean apples-to-apples view reveals where to negotiate: some factories flex on tooling rebates, others on scrap-credit percentages or payment terms. - Validate quality credentials early.

Before haggling cents, ask for the latest ISO 22000 or BRCGS certificates, migration-test reports, and machine-compatibility data. If a supplier hesitates, walk. Premium capsules live or die on documentation. Many emerging brands save weeks by scheduling a remote video audit instead of an on-site visit. Modern fillers will accommodate. - Run a pilot batch. Paid, not free.

Insist on a 5,000-10,000-unit pilot using production tooling, even if it costs extra. You’ll confirm fill accuracy, lidding integrity, and sensory performance before committing to the full MOQ. The data from that pilot becomes the reference standard for every future shipment. - Lock production windows and logistics in writing.

Secure your slot with a formal purchase order that spells out deliverables: start date, completion date, pallet count, artwork freeze deadline, and payment milestones (e.g., 40% deposit, 60% on pre-shipment inspection). Confirm incoterms – FOB, CIF, or DDP – so freight surprises don’t crop up post-run. - Align marketing with delivery.

As soon as the factory confirms the shipping ETA, back-schedule your launch assets – sleeve photography, retailer sell-in decks, email flows – so sales momentum hits the moment pallets clear customs. A perfectly timed announcement can halve warehouse dwell time and accelerate cash recovery on that inaugural MOQ. - Plan your recycling narrative.

Order branded collection bags or partner with an existing aluminum take-back program before the first capsule ships. Adding a QR code on-pack that explains how consumers can recycle turns sustainability from a future promise into day-one practice, and positions your brand as part of the solution, not the problem.

Follow these steps in sequence and your first aluminum run shifts from daunting expenditure to disciplined, de-risked investment, laying the operational and brand foundation for every batch that follows.

Turning MOQ from Barrier to Competitive Edge

Choosing aluminum capsules at a higher minimum order quantity can feel like stepping onto a financial high-wire. Yet once you unpack the numbers, and the brand implications, the calculus changes. Tooling amortizes quickly. Per-unit costs converge with plastic by the 150 K mark and can all but disappear at 500 K.

Meanwhile, aluminum’s airtight barrier preserves flavor longer, its scrap value trims compliance fees, and its mono-material recyclability earns you retailer favor you simply won’t get with mixed plastics.

When you view MOQ through that full-cycle lens – cash flow, shelf-life security, sustainability metrics, and premium brand perception – the up-front commitment stops looking like a risk and starts looking like a moat.

Emerging brands that master community runs, phased tooling, and clear-eyed demand planning can capture aluminum’s upside without overstretching capital. Established players can parlay larger MOQs into cost leadership and a sustainability story that locks in long-term contracts.

The message is clear: the “minimum” in MOQ isn’t a ceiling on ambition, it’s the launchpad for a capsule program that scales, protects every nuance of your roast, and signals to buyers that you’re serious about both quality and the planet.

Partner with an experienced supplier. NovoCapsule stands ready to help, and turn that initial volume commitment into a sustainable, flavor-first advantage your competitors can’t match.

NovoCapsule turns MOQ into a competitive edge. Our proprietary extra-strong aluminum alloy resists micro-dents that can trigger leaks, while a wider sealing rim guarantees flawless lidding, meaning you hold less safety stock for QC issues and get more sellable cups per run. Behind every capsule is a zero-defect production workflow, audited at each stage to keep your first pallet as precise as your millionth.

Ready to lock in premium quality at scale? Talk to us today and secure your production slot.

***

Frequently Asked Questions – Quick Reference

What is the typical minimum order quantity (MOQ) for aluminum capsules?

A first production run usually starts around 30,000-35,000 capsules per SKU. Below that, setup and tooling costs make per-unit pricing uncompetitive.

Why do aluminum suppliers insist on larger MOQs than plastic pod makers?

Aluminum presses run at very high speeds and require time-intensive calibration. Suppliers need a longer, uninterrupted run to recoup that setup time and keep unit costs reasonable.

Can I negotiate a lower MOQ for a pilot launch?

Yes. Ask about “community runs” or shared tooling slots. You’ll pay a small scheduling premium, but volumes can drop to 20,000 units without compromising quality controls.

How long can filled aluminum capsules stay fresh in storage?

With proper nitrogen flushing and a cool, dry warehouse, flavor typically holds for 12–15 months, about double the shelf life of most plastic pods.

Do I need separate tooling if I add new blends later?

Not usually. The same body tooling works for multiple coffees; only lid artwork or sleeve printing changes, which has minimal impact on MOQ.

What certifications should I request before signing off on production?

Look for compliance with ISO 22000 or BRCGS food-safety standards, plus migration-test reports proving no metal leaches into the coffee.

How does the recycling process work for spent aluminum capsules?

Consumers empty or rinse the capsule, then place it in metal recycling streams or brand-run collection bags. The aluminum is smelted and reused, often in new capsules, without quality loss.

Will switching to aluminum raise my extended-producer-responsibility (EPR) fees?

No. In many jurisdictions, mono-material aluminum actually reduces EPR levies because its resale value offsets municipal collection costs.

Are aluminum capsules compatible with third-party sealing films and lidding materials?

Most fillers stock standard high-barrier, heat-seal films that bond securely to aluminum; lab trials confirm adhesion before bulk production.

What is the fastest way to recover tooling costs?

Plan a follow-up order within three to six months. Doubling cumulative volume from the initial run can cut tooling amortization per unit by more than half, bringing total cost close to plastic while preserving flavor and sustainability advantages.